cap and trade vs carbon tax canada

However some differences exist. Quebecs cap and trade system provides 100 relief to process emissions.

Carbon Pricing In Canada Wikipedia

This was partly due to lower production volume overall but the.

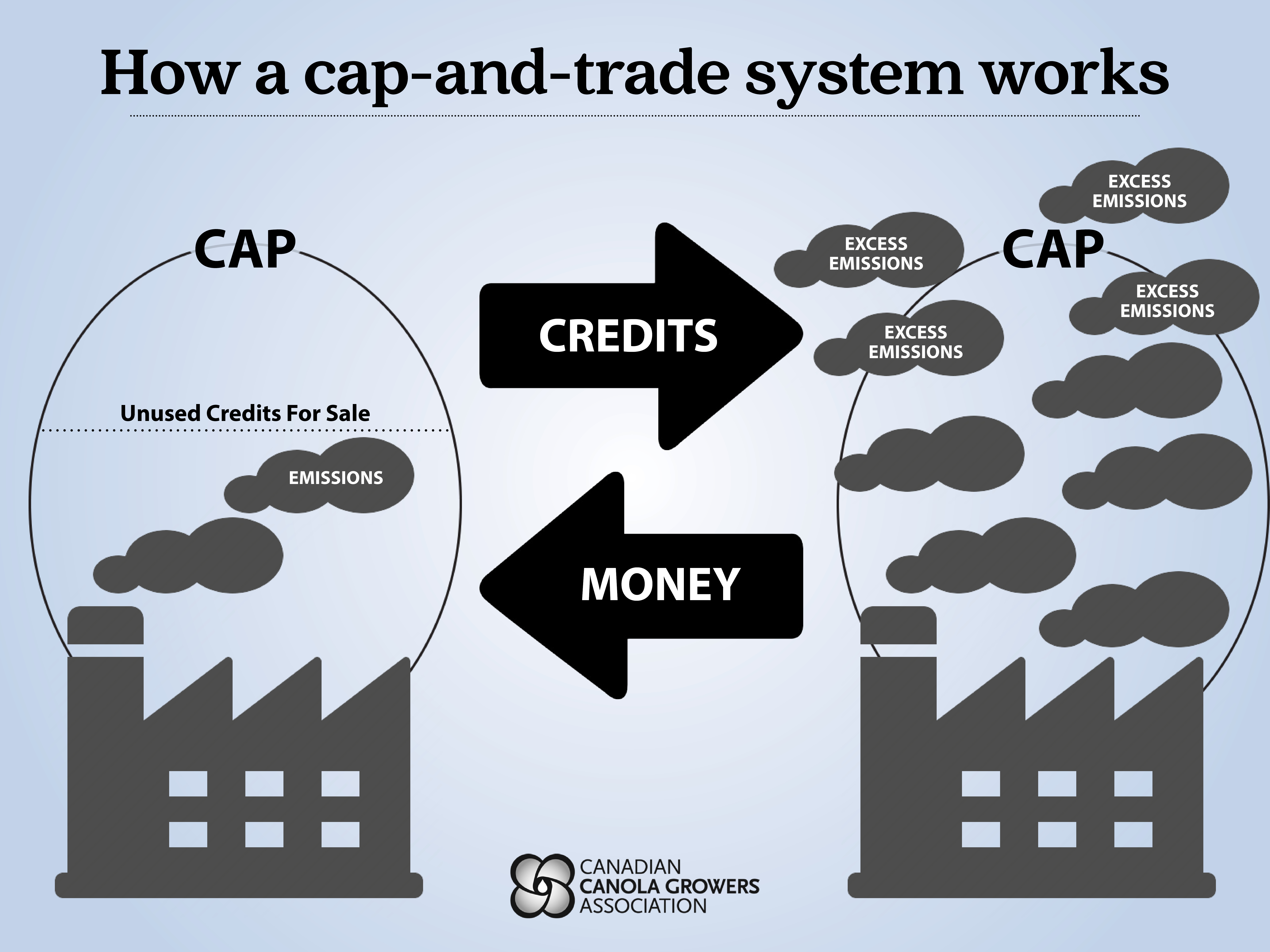

. With a tax you get certainty about prices but uncertainty about emission reductions. It provides more certainty about the amount of emissions re See more. On the other hand political economy forces strongly point to less.

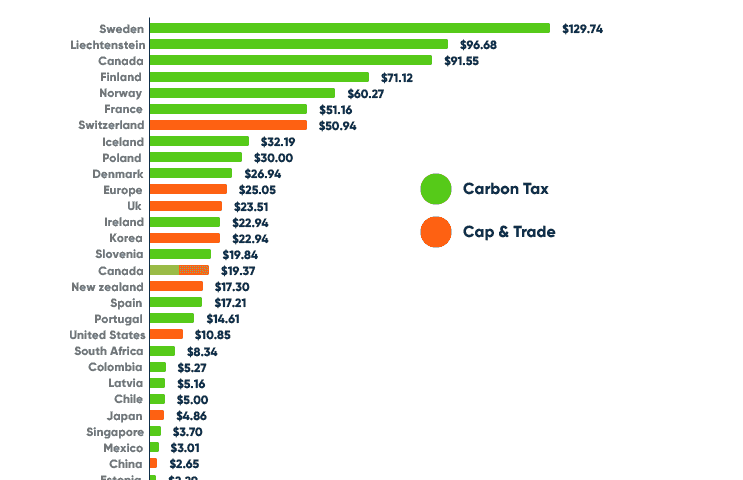

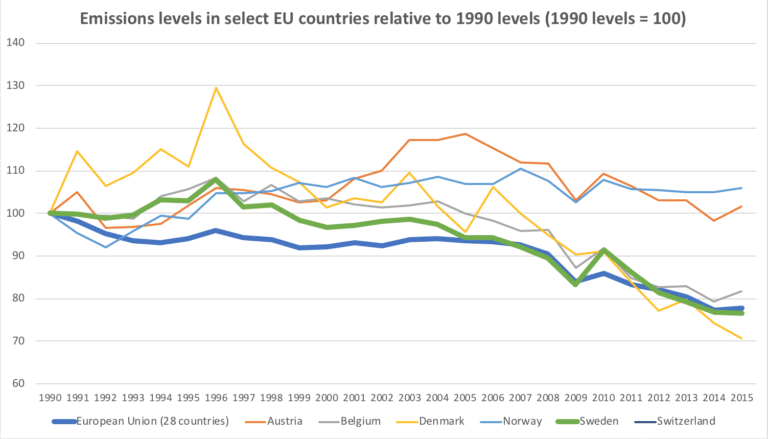

But based on the previous analysis for Canada the method that can impact carbon dioxide emissions the most is the carbon tax system. With a cap you get the inverse. The policies are or can be made roughly equivalent.

Provincial fuel charge federal OBPS. With a tax you get certainty about prices but uncertainty about emission reductions. April 9 2007 413 pm ET.

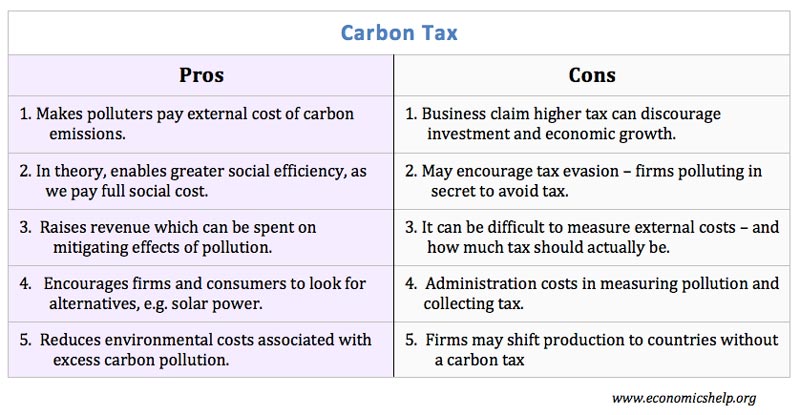

Carbon Tax vs. This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so by treating. You can tweak a tax to shift the balance.

-Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas. A proper carbon tax will deter fossil fuels and.

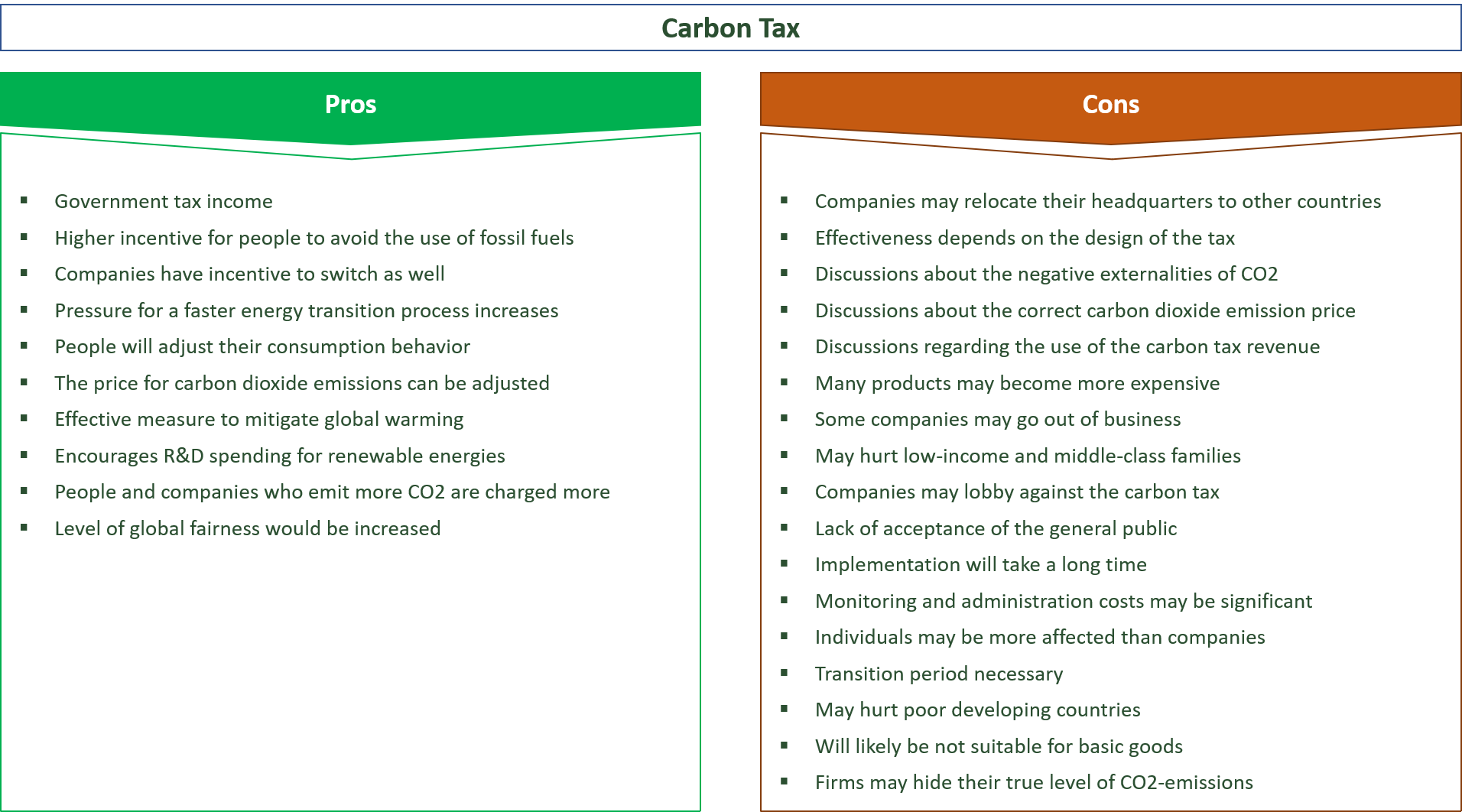

The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas. Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy. Both a carbon tax and a cap-and-trade system would result in higher energy costs to consumers.

Provincial carbon tax and OBPS. Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario. Carbon tax approaches however can be designed such.

Cap-and-trade has one key environmental advantage over a carbon tax. Starting in 2021 process emissions will be subject to a tightening rate of 05 per year. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing.

A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism. With a cap you get the inverse. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham.

-Alt-FI.jpg?t=1638306544&width=826)

Experts Talk Carbon Markets At Ontario Energy Conference Rto Insider

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

The Effect Of Carbon Pricing On Technological Change For Full Energy Decarbonization A Review Of Empirical Ex Post Evidence Lilliestam 2021 Wires Climate Change Wiley Online Library

What Is Carbon Pricing Canadian Canola Growers Association

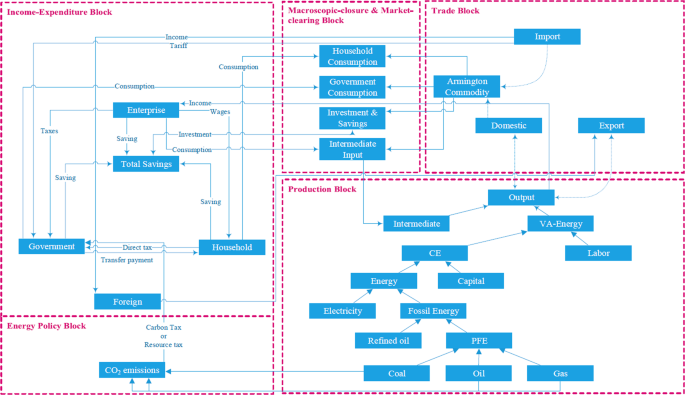

Supply Control Vs Demand Control Why Is Resource Tax More Effective Than Carbon Tax In Reducing Emissions Humanities And Social Sciences Communications

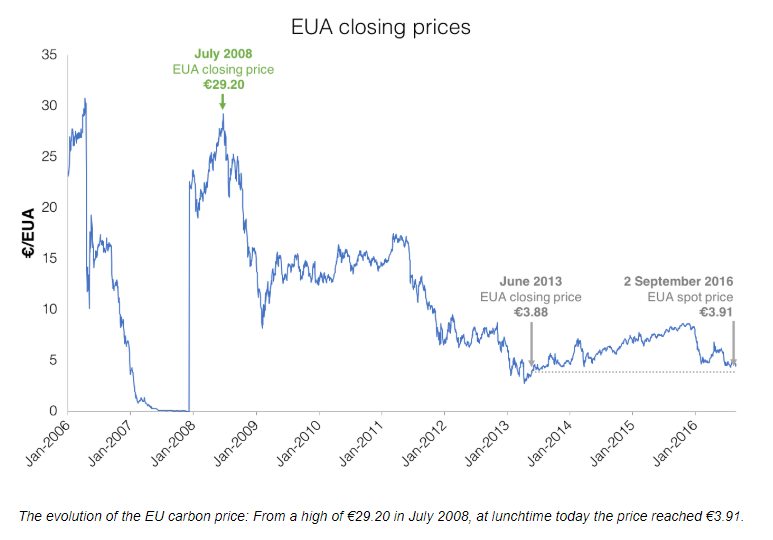

These Countries Have Prices On Carbon Are They Working The New York Times

Carbon Tax Pros And Cons Economics Help

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

A Comparison Of Cap And Trade Vs Carbon Tax Regulation December 201

27 Main Pros Cons Of Carbon Taxes E C

Carbon Markets Putting A Price On Carbon Green City Times

Carbon Tax Most Powerful Way To Combat Climate Change Imf

Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World Sciencedirect

Carbon Markets Putting A Price On Carbon Green City Times

Economist S View Carbon Taxes Vs Cap And Trade

Carbon Tax Pros And Cons Economics Help

Canada Passed A Carbon Tax That Will Give Most Canadians More Money Climate Crisis The Guardian